Getting My Hsmb Advisory Llc To Work

Wiki Article

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

Table of ContentsSome Known Incorrect Statements About Hsmb Advisory Llc The smart Trick of Hsmb Advisory Llc That Nobody is Talking AboutThe Definitive Guide to Hsmb Advisory LlcThe Facts About Hsmb Advisory Llc RevealedA Biased View of Hsmb Advisory LlcHow Hsmb Advisory Llc can Save You Time, Stress, and Money.

Ford states to stay away from "cash money value or irreversible" life insurance policy, which is more of an investment than an insurance coverage. "Those are really made complex, come with high commissions, and 9 out of 10 people do not require them. They're oversold due to the fact that insurance coverage agents make the biggest payments on these," he states.

Disability insurance coverage can be costly. And for those that opt for long-term treatment insurance coverage, this plan might make special needs insurance policy unnecessary. Find out more concerning lasting treatment insurance coverage and whether it's ideal for you in the following section. Long-term care insurance coverage can help spend for expenses associated with lasting treatment as we age.

Facts About Hsmb Advisory Llc Revealed

If you have a chronic wellness worry, this sort of insurance coverage might wind up being critical (Insurance Advisors). Nonetheless, do not allow it stress you or your savings account early in lifeit's normally best to take out a policy in your 50s or 60s with the expectancy that you will not be using it till your 70s or later.If you're a small-business proprietor, take into consideration securing your resources by purchasing company insurance. In the occasion of a disaster-related closure or period of rebuilding, company insurance coverage can cover your income loss. Consider if a significant climate occasion impacted your store front or manufacturing facilityhow would certainly that affect your income? And for for how long? According to a report by FEMA, between 4060% of tiny organizations never ever resume their doors adhering to a calamity.

Plus, making use of insurance can in some cases set you back more than it conserves in the future. If you get a chip in your windshield, you may consider covering the repair work cost with your emergency financial savings rather of your automobile insurance coverage. Why? Due to the fact that using your auto insurance coverage can cause your monthly costs to increase.

Some Known Details About Hsmb Advisory Llc

Share these pointers to secure liked ones from being both underinsured and overinsuredand talk to a trusted expert when required. (https://www.easel.ly/browserEasel/14439798)Insurance policy that is bought by a private for single-person coverage or insurance coverage of a household. The individual pays the costs, rather than employer-based medical insurance where the company typically pays a share of the premium. People may go shopping for and purchase insurance policy from any type of plans readily available in the individual's geographical region.

People and families might qualify for monetary help to lower the expense of insurance policy premiums and out-of-pocket prices, however just when signing up through Attach for Health And Wellness Colorado. If you experience specific changes in your life,, you are qualified for a 60-day time period where you can register in a private plan, even if it is beyond the annual open registration period of Nov.

The Ultimate Guide To Hsmb Advisory Llc

- Attach for Health Colorado has a full list of these Qualifying Life Occasions. Reliant youngsters who are under age 26 are qualified to be consisted of his comment is here as relative under a parent's protection.

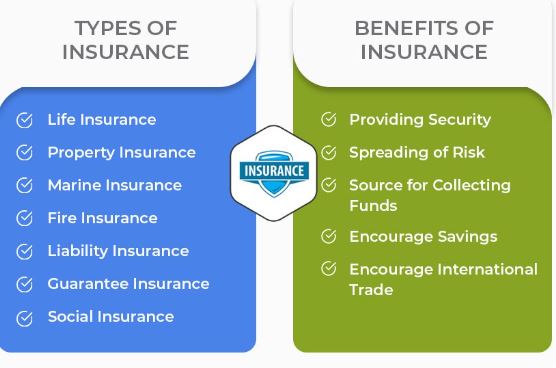

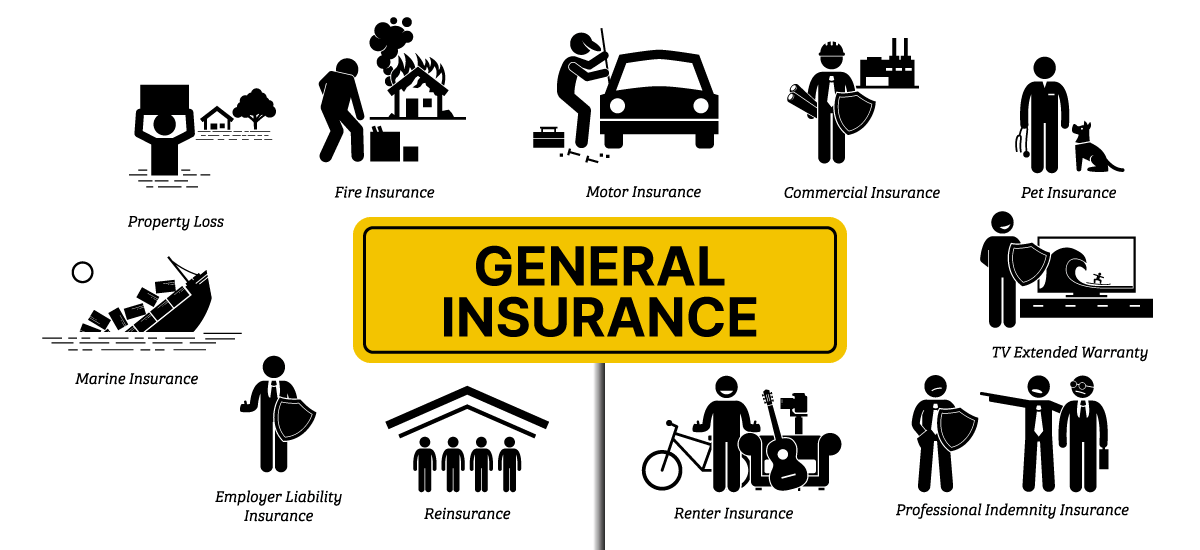

It may seem simple yet understanding insurance types can additionally be perplexing. Much of this complication originates from the insurance sector's recurring goal to develop individualized coverage for policyholders. In developing flexible plans, there are a variety to choose fromand every one of those insurance types can make it challenging to comprehend what a details policy is and does.

Some Known Details About Hsmb Advisory Llc

If you die throughout this duration, the person or individuals you've called as beneficiaries might get the money payout of the plan.

However, several term life insurance plans allow you transform them to an entire life insurance policy policy, so you do not shed coverage. Generally, term life insurance policy plan costs settlements (what you pay each month or year into your plan) are not locked in at the time of acquisition, so every 5 or ten years you have the policy, your costs can climb.

They additionally tend to be more affordable overall than entire life, unless you acquire an entire life insurance policy policy when you're young. There are also a few variations on term life insurance policy. One, called team term life insurance coverage, prevails amongst insurance policy options you may have accessibility to via your employer.

The Basic Principles Of Hsmb Advisory Llc

This is normally done at no charge to the worker, with the capacity to buy additional coverage that's obtained of the worker's paycheck. An additional variation that you may have access to via your employer is extra life insurance policy (Insurance Advisors). Supplemental life insurance coverage can include unintentional fatality and dismemberment (AD&D) insurance coverage, or funeral insuranceadditional coverage that might aid your family in case something unanticipated happens to you.

Long-term life insurance coverage simply refers to any kind of life insurance coverage policy that doesn't end.

Report this wiki page